The 50/30/20 Rule: A Simple Way to Budget for People Who Hate Budgeting

Discover how this classic method of budgeting can help you get a handle on your finances, reduce stress, and create a foundation for a secure financial future.

Taking care of money can seem daunting — particularly when you’re trying to balance bills, savings goals and sporadic bills and expenses. But what if there were a simple, easy-to-follow rule that could help lead you toward financial stability without requiring a degree in finance? That, my friends, is where the 50/30/20 Rule comes in — a simple formula that makes budgeting easy and actually works for any income, high or low.

Whether you’re struggling to make it from paycheck to paycheck, or eager to optimize your financial habits, this rule could be a clear path to smarter money management. Let’s dissect it, and figure out how to apply it to your own life.

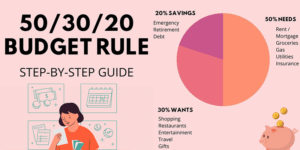

What Is the 50/30/20 Rule?

It is a budgeting strategy that splits your after-tax income between three core areas:

50% for Needs

30% for Wants

20% Savings and Debt Repayment

This rule of thumb is propagated by US Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan”. It’s a pretty simple plan to simplify people’s financial planning and ensure some sense prevails in the balance between unessential spending and long-term goals.

Let’s take a look at what’s in each — and why it matters.

30% for Needs: The Basics of Life

Your “needs” are your non-negotiable expenses that keep you alive and functioning. This includes:

Rent or mortgage payments

Works (electricity, water, gas)

Groceries

Health insurance

Minimum loan payments

Automobile (loan payments, gas, public transportation)

These are things you are supposed to pay every month, regardless of financial goals or preferences. If your necessities are over 50% of your income, it might be a signal to look for an alternative living situation or a job with a cheaper commute.

Tip: Be rigorous about what constitutes a “need.” A phone plan is a necessity, but the new smartphone update isn’t. Eating also: needing groceries is one thing, but dining out is a “want.”

30% Wants: Enjoying Life Responsibly

The “wants” category includes discretionary purchases — the extras that enrich your life, but that aren’t absolutely required. Think:

Dining out and takeout

Subscriptions (Netflix, Spotify)

Hobbies and entertainment

Travel and vacations

Buying non-essential items

Here is your opportunity to spoil yourself with special moments, and another way to make your life meaningful. Devoting 30 percent of your budget to wants ensures you don’t feel deprived and keeps your finances in check.

Tip: Wants can easily disguise themselves as needs. You may feel that a new car is absolutely necessary, but perhaps a used one that costs less will do what you really need it to. Just be aware of lifestyle inflation.

20 Percent for the Future of You: Saving and Paying Off Debt

Your last 20% of income should be used for:

Emergency savings

401(k), IRA retirement accounts

Paying down credit card debt

Additional payments toward student loans or mortgage

Investing

This category, after all, is all about protecting your future, financially. By regularly saving and paying down debt you build in financial flexibility and reduce stress over time.

Tip: Focus on building an emergency fund of eight, 3–6 months of expenses. Once with that in place, then turn attention to high-interest debt and long-term savings such as retirement.

Using the 50/30/20 Rule to Plan Your Budget

Ready to implement the rule? Here’s a step-by-step guide:

Determine Your After-Tax Income

Begin with determining what your monthly take-home pay is. If you’re self-employed, you can reduce estimated taxes and costs specifically associated with your business to arrive at a more accurate number.

Break Down Your Spending

Monitor what you spend during the day and label it as an expense being a need, a want, or savings/debt. Apps including Mint, YNAB or just a good ol’ spreadsheet can be useful.

Compare to the Ideal Split

Compare your spending with the 50/30/20 targetted, and see how your current spending matches up. Are you spending too much money on wants? Are your needs above 50%?

Adjust Where Necessary

If your categories are out of whack, aim to make cuts. Is there any way you can reduce your rent, or refinance that car loan? Cancel unused subscriptions?

Set Automatic Transfers

Automate savings and debt repayment to make sure the money goes where it needs to go — before you spend it on something else.

Who Benefits Most From the 50/30/20 Rule?

This rule is ideal for:

New investors just beginning the financial journey

Those with irregular income, such as freelancers or gig workers

Anyone who is intimidated by complicated budgeting tactics

But it’s not the same for everyone. High earners may be able to save more than 20%, and low earners may need more flexibility. Take this as a principle, it is not a hard and fast rule.

Tailoring the Rule to Fit Your Finances

Life happens — and so should your budget. Here are several ways that you can modify the 50/30/20 rule based on your specific goals:

Aggressive Debt Repayment: Move some of your “wants” budget over to pay off high-interest debt more rapidly.

Retirement Plans: Want to slash lifestyle in half and keep savings above 20%.

Life on a Lower Income: Think about a 60/20/20 or 70/10/20 split to make more room for “needs.”

The key is to stay flexible. It’s an infrastructure to help you stay upright —— not to control your life.

Benefits of the 50/30/20 Rule

Clarity: Reduces budgeting to three buckets.

Balance: Promotes spending responsibly without feeling deprived all around.

Flex: Can be tweaked to match changing circumstances.

Focus: Encourages consistent prioritization of saving and paying off debt.

This is the essence of the 50/30/20 rule: a focal point on financial mindfulness, the act of knowing exactly where your money is going, and why.

Common Pitfalls to Avoid

Underestimating “Needs” – Wants and Needs should not to be confused. Keep this category lean.

Not Saving – Little payments do make a difference. Don’t skip the 20%.

Forgetting about Irregular Expenses – Budget for a year’s expenses, such as insurance premiums or vacations.

Failing to Change Your Budget – Life changes. !!} We recommend reviewing and modifying your budget every three months.

Final Thoughts

In a financial landscape cluttered with complex investment tools and ever-changing advice, the 50/30/20 rule is unique for its simplicity and effectiveness. It’s not a cure-all, but it’s a good launching point for anyone looking for more control over their money.

Now, you can have the best of both worlds, by living in the now without jeopardizing your then. You’ll relieve stress, build confidence and establish a foundation for long-term financial wellness.

Start today: Take a look at your most recent bank statement, and split your spending into these three buckets to see how you’re doing. There’s only a modest amount of fiddling necessary to turn the 50/30/20 rule into the single most potent habit in your financial arsenal.

Our Post

Mastering Dividend Growth Investing: Your Path to Lasting Financial Freedom

Master Your Money: The Ultimate Blueprint for Financial Freedom