How Big Should an Emergency Fund Be?

Determine what the right balance for your lifestyle, income, and financial goals is.

An emergency fund is one of the first building blocks of personal finance. It’s the cushion you rely on for those unexpected costs, like being laid off, a medical emergency or a sudden car repair. But just how much should you save? The answer isn’t the same for everyone — and with inflation, rising interest rates and an economy shrouded in uncertainty in 2025, the stakes are higher than ever.

Let’s unpack how to determine just how much an emergency fund should be, why it makes sense to have that much and how to put together an emergency fund more quickly — and potentially while you are still dealing with credit card debt.

Why You Need an Emergency Fund in 2025

Life has a way of throwing unexpected expenses our way. From a visit to the ER to a sudden layoff, emergencies can happen at any time — and they usually come with a hefty price tag.

In a 2024 survey by Bankrate, 57% of Americans still can’t handle a $1,000 emergency without borrowing it or charging it to their credit card. That’s risky. As for credit cards, depending on them can create high-interest debt that mushrooms, particularly if you already have outstanding balances.

An emergency fund in today’s up-and-down economy provides you with breathing room and health for your finances.

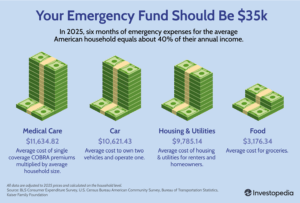

The Classic Rule: 3 to 6 Months of Expenses

This is still the most popular rule of thumb, used by banks and personal finance experts, and it’s where many people can come up short.

The rule of thumb is to stash away three to six months’ worth of your essential living expenses. This range gets us somewhere, but let’s unpack it:

3 months is what’s usually suggested for single people with steady employment and few dependents.

6 months is more appropriate for families, those living on a single income, or individuals with irregular earnings, such as freelancers or gig workers.

So if your essentials (housing, food, transportation, insurance and minimum debt payments) total $3,000 a month, your emergency fund should be between $9,000 and $18,000.

What Affects the Amount You Need in an Emergency Fund

Rather than adhering to one-size-fits-all advice, it makes sense to tailor how much you save to your specific financial reality. Here’s what to consider, in terms of a planet’s capacity to support life:

Job Stability

Do you work in an (a) secure (b) or (b) layoff-prone industry? The less stable your job, the more you need to save. So not until 2025 will we find more sectors experiencing volatility in growth (tech and media), while a couple are seeing less (healthcare and education).

Health and Insurance Coverage

If you are covered by high-deductible insurance or have ongoing medical needs, a larger cushion could protect you from unexpected out-of-pocket expenses.

Dependents

If you have a spouse, children or elderly parents to support, you will need a larger buffer to ensure that all household needs can be made in periods of hardship.

Debt Obligations

High-interest debt like credit card balances can drain your income fast. Debt hawks will say you should pay all that off, but this is an emergency, so $1,000–$2,000 as a starter emergency fund helps keep your balances out of the picture during an emergency.

Cost of Living

Your location also matters. Being a resident in an expensive city like New York or San Francisco will require you to have more emergency cash than someone who lives in a less expensive area.

What You Need to Know: How to Figure Out How Much You Need in an Emergency Fund

Here’s how to calculate, step by step, what your emergency fund should be:

Make a list of your absolute need on a monthly basis.

These would be rent/mortgage, utilities, food, transportation, insurance, childcare and debt payments.

Multiply by 3 to 6 months.

Plug in 3 months if you have two sources of income and job stability. Err on the 6-month side if your income varies or you’re the sole breadwinner.

Copy for lifestyle and risk factors.

Bump up your target if you have health issues, dependents or freelancing income.

Example:

What You Spend a Month

Monthly essential expenses: $3,200

Goal Emergency Fund (4 months of essentials): $12,800

Where to House the Emergency Fund?

The answer is that whatever the best place for your emergency fund is, it should be safe, liquid and accessible — but not too accessible, lest you be tempted to dip into it.

Top Options:

High-yield savings accounts: They pay competitive interest rates (more than 4.00% APY as of 2025) and are readily available.

Money market accounts: Offers a little more interest and some check-writing options.

Certificates of deposit (CDs): Only for some percentage of your fund if you can forgo ready access.

Don’t put your emergency fund into the stock market. And while equities may offer a higher long-term return, the value can plummet just when you’re ready to spend the cash.

How to Accelerate Your Emergency-Fund Contributions

When you’re living paycheck to paycheck, the thought of saving thousands can be overwhelming. But with the proper approach, you can make consistent headway.

Set a Monthly Goal

Whittle your big goal down into mini goals. Save $200 a month and you will have socked away a $2,400 cushion in just one year.

Automate Your Savings

Set up automatic transfers from checking to savings immediately after each paycheck.

Cut Unnecessary Expenses

Cancel subscriptions you don’t use, cook at home more frequently, and check out who you are paying regularly.

Use Windfalls Wisely

Both tax refunds and employer bonuses can be a great source of acceleration as can cash back you receive on your credit card.

Open a Dedicated Account

There’s also the point that it’s harder to spend when a goal is clearly visible, as you’re apt to think twice before tapping into an account with an earmarked goal just because you can.

Let’s say you have credit card debt that you want to pay off, and you have some money saved.

It’s a tough balance. Credit card interest, on the other hand, is expensive. On the other, emergencies can also result in more debt if you’re not prepared.

Best Strategy:

Build a beginning emergency fund of $1,000–$2,000, then pay minimum payments on all debts. Once you have that in place, shift toward more aggressive payments to knock out those high-interest credit cards. After your debt is manageable, increase your emergency fund to 3–6 months.

Savings vs. Credit Cards

But what if I need to make an immediate purchase and don’t have any money? In reality, this is risky.

Credit cards:

Why do they charge high APR when they lend money?

Can be maxed — or frozen — in times of financial strain

Don’t take the same peace of mind as hard savings

Credit cards can play a role in your overall backup plan, but they should never take the place of stored cash.

Final Thoughts

An emergency fund is not just a pile of cash — it’s peace of mind, financially speaking. It protects you from debt, stress and snap decisions during life’s worst times. Whether you have $50 or $5,000 to start with, the point is to start now.

In 2025, in the face of economic uncertainty and lingering inflation, a strong emergency fund isn’t just smart — it’s necessary. Spend some time working out your goal, devising a strategy, and sticking to it. Future you will thank you.

Our Post

Mastering Dividend Growth Investing: Your Path to Lasting Financial Freedom

Master Your Money: The Ultimate Blueprint for Financial Freedom