A New Way for Cardholders to Use Their Charges

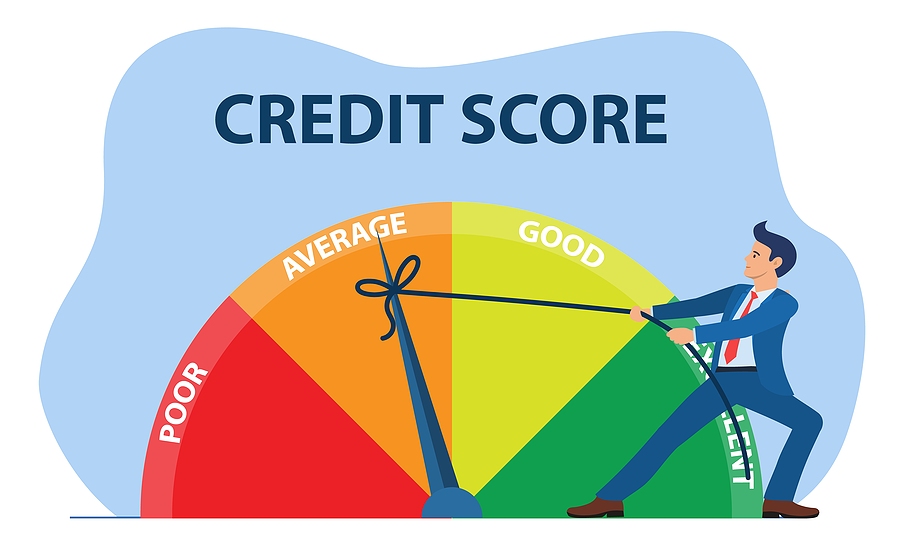

A New Way for Cardholders to Use Their Charges In an age when Americans are fighting increasing living costs as well as ballooning debt, one bill is actually trending for the right reasons. The Rate… A New Way for Cardholders to Use Their Charges